|

Leffingwell &

Associates

|

|

|||||||||||||||||||||

2005 - 2009 Estimated Sales Volume in

Millions

(Final Estimates as of October 13, 2010)

|

Leffingwell &

Associates

|

|

|||||||||||||||||||||

2005 - 2009 Estimated Sales Volume in

Millions

(Final Estimates as of October 13, 2010)

.. Company 2005 2005 Est. 2005 2006 2006 Est. 2006 2007 2007 Est. 2007 2008 2008 Est. 2008 2009 2009 Est. 2009 .. Rank .. Country Currency =US $ Market Share1 Country Currency =US $ Market Share1 Country =US $ Market Share1 Country =US $ Market Share1 Country =US $ Market Share1 Source 1 Givaudan 2,778 CHF $2,108.9 13.2% 2,909 CHF $2,387.9 13.3% 4,132 CHF $3,647.0 18.4% 4,087 CHF $3,828.7 18.9% 3,959 CHF $3824.0 19.1% 2(3) Firmenich 2,308 CHF $1,752.1 11.0% 2,500 CHF $2,052.1 11.4% 2,847 CHF $2,512.8 12.7% 2,641 CHF $2474.1 12.2% 2,873 CHF $2775.0 13.9% 3 IFF $1,993.4 $1,993.4 12.5% $2,095.4 $2,095.4 11.6% $2,276.6 $2,276.6 11.5% $2,389 $2,389 11.8% $2326.2 $2326.2 11.6% 4 Symrise 1,148.9 € $1,360.2 8.5% 1,230.0 € $1,623.0 9.0% 1,274.5 € $1,860.8 9.3% 1,319.9 € $1837.4 9.1% 1362.0 € $1952.5 9.8% 5(4) Takasago ¥105,721 $898.3 5.6% ¥113,876 $955.7 5.3% ¥124,231 $1,112.0 5.6% ¥123,973 $1365.6 6.7% ¥114,347 $1228.5 6.1% 6 (6) Sensient Flavors $516.4** $516.4** 3.2% $535.4** $535.4** 3.0% ~$572** ~$572** 2.9% ~$591** ~$591** 2.9% ~$548.7** ~$548.7** 2.7% 7 Mane SA 263 € $311.4 1.9% 288 € $380.0 2.1% 307.31 € $448.7 2.3% 332.5 € $462.9 2.3% 376.2 € $539.3 2.7% 8 (5) T. Hasegawa ¥47,752 $405.7 2.5% ¥47,000 $394.4 2.2% ¥50,066 $448.1 2.3% ¥45,421 $500.3 2.5% ¥43,244 $464.6 2.3% 9 Robertet SA 207 € $245.1 1.5% 221.13 € $291.8 1.6% 241.14 € $352.1 1.8% 303.17 € $422.0 2.1% 305.1 € $437.4 2.2% 10 Frutarom $243.8 $243.8 1.5% $287.2 $287.2 1.6% $368.3 $368.3 1.9% $473.3 $473.3 2.3% $425.2 $425.2 2.1% ... Top Ten Totals ..... $10,555.0* 66.0%* .. $11,867.6* 65.9%* .. $13,598.4 68.7% ... $14344.2 70.7% ~$14521.4 72.6% .. All Others ... $5,445.0 34.0% .. $6,132.4 34.1% .. $6201.6 31.3% ... $5955.8 29.3% ~$5478.6 27.4% .. Total Market .. $16,000 ... .. $18,000 .. .. $19,800 .. ... $20,300 .. $20,000 ..

* Note - Top 10 Total figures includes Quest International for Years

2004-2006 and excludes sales of Frutarom for the same period, as 2007

was Frutarom's 1st year in the Top 10.

Currency

Currency

Currency

In 2009, based on comparison of major currency rates (on Dec. 31), the U$ $ had a decline of 3.1% against the Swiss Franc, a an increase of 2.5% against the Japanese Yen and a 3% decline against the Euro. However, comparing single points in time can be somewhat misleading as during the period of April to November 2008, the dollar had a decline of about 10% against the Euro. For most major companies, the last half of 2009, and especially the 4th Qtr, was reasonably strong, offsetting to a major degree the setbacks in the early part of the year. We estimate that the total market declined only marginally in US $ from 2008. To a large degree this was due to currency exchange rates of a weaker US $ vs. the Euro & Swiss franc. Excluding these exchange rate benefits, we estimate that the industry actually declined about 1.7% in 2009. No matter which comparison one uses, the industry performance was markedly better than our early year (February 2009) projection of a real decline of 4-6%.

For the numerous small flavor & fragrance companies, which continue to lose market share, we estimate an overall sales decline in US $ of about 7.2%.

Sales results for 1999 to 2002 are available HERE and for 2002 to 2006 click HERE and for 2004 to 2008 click HERE. These tables include Quest International in the Top 10 for years 1999-2006.

(3) Accounting Period of July 1 to June

30

(4) Accounting Period of April

1 to March 31

(5)Accounting Period of Sept. 1

to August 31; Net sales given are Company consolidated sales, See

T.Hasegawa

Co., Ltd.

(6) Accounting Period of Sept.

1 to August 31 until year 2000. In year 2000, Universal Foods changed

is name to SENSIENT TECHNOLOGIES CORPORATION and the Flavor division

is now known as Sensient Flavors. In addition, the accounting period

was changed to January 1 - December 31 starting in year 2000 and in

the "funny" way of making one look larger than they really are in

F&F, Sensient's Flavor sales include "Dehydrated Products"

(onion/garlic/chilies/dehydrated vegetables) which are not flavors

or fragrances in the conventional sense. In our figures for

Sensient, we have removed sales for the "Dehydrated

Products".

Note - for companies with

accounting periods that overlap calendar years, sales are stated for

the year in which the majority of sales periods occur. For example,

if Takasago's year end is March 31, 2002 we treat that as year 2001

sales. Similarly, if Firmenich's year end is June 30, 2002 we report

the year ending as 2001 sales. While not exact, we feel that this

treatment still provides an accurate overall basis for comparison.

Similarly, as noted, currency calculations are based on calendar year

end rates for comparison consistency. If fiscal year end rates were

employed the U.S. $ figures would be somewhat different, but totally

confuse comparisons.

Note - Top Ten Total for market share does

not add due to rounding for individual

companies.

Note - all foreign currency

calculations for the table are based on December

31 rates for the year

indicated

** See Note (6). F&F figures in the

table above for Sensient Flavors are estimates

as we have removed reported sales of

"Dehydrated products" (27% of reported F&F revenues) from

their stated "Flavor & Fragrance Sales" of $525.7 million for

2001; 26% of reported F&F revenues of $572.2 million for 2002;

24% of reported F&F revenues of $594.7 million 2003; 23% of

reported F&F sales of $648.3 million (restated) in 2004 and 23%

of reported F&F sales of $670.6 million in 2005 in order to have

a reasonable year to year comparison. In 2006, dehydrated products

were 27% of the reported F&F sales, in 2007 & 2008 also about

27% of sales.

Firmenich

2009-2010 Sales

- Oct. 13, 2010 - For the financial year ended

June 30, 2010, Firmenich posted record sales of CHF 2873 million, an

increase of 12.1% in local currencies and 8.7% in Swiss Francs,

regaining its position as growth leader in the fragrance and flavor

industry. This performance was driven by double-digit growth in

Perfumery and Flavor segments, with a particularly strong rebound in

Fine Fragrance during the second half of the year. The perfume and

flavor ingredients business followed the trend, recording a healthy

high single-digit growth performance.

Leffingwell estimates that Firmenich

increased market share by about 1.7% in the period.

Takasago Full Year 2009-2010 Sales - May 14, 2010 - Sales for the full fiscal year ending March 31, 2010 were ¥114,347 million, down 7.8% from the prior year.

Frutarom 4th Qtr & Full Year 2009 Sales - Haifa, Israel – March 16, 2010 - Frutarom's full year sales fell 10.2% (in US $) vs. 2008, totaling $425.2 million. 4th Qtr sales increased 9.9% to $108.5 million.

Symrise Full Year 2009 Sales - Holzminden, March 3, 2010 - The company increased sales by 3.2 % at actual rates and by 2.7 % at local currency. The Flavor & Nutrition division increased revenues from € 648.1 million to € 679.7 million in the 2009. The Scent & Care division benefited from an increase in business during the second half of the year. Sales for the division rose by 1.6 % to € 682.3 million (previous year: € 671.8 million).

Givaudan 4th Qtr & Full Year 2009 Sales - Geneva - Feb. 16, 2010 - In 2009, Givaudan group sales totaled CHF 3,959 million, an increase of 1.4% in local currencies and a decrease of 3.1% in Swiss francs compared to 2008. On a comparable basis (in local currencies and excluding the impact of divestments), sales increased by 1.6% versus 2008. The Fragrance Division recorded full year sales of CHF 1,824 million, an increase of 0.9% in local currencies and a decrease of 3.9% in Swiss Francs. After a challenging first quarter, business momentum recovered, improving consistently during the three consecutive quarters. The Division achieved sales growth of 5.3% in local currencies during the 4th Qtr 2009. The Flavour Division reported full year sales of CHF 2,135 million, representing a growth of 1.9 % in local currencies and a decline of 2.5 % in Swiss francs. Excluding the effects of the divested business, sales performance in local currencies increased 2.2%. During the fourth quarter of this year, the Division achieved sales growth of 4.3% in local currencies.

Robertet 2009 Sales - Feb. 15, 2010 - Robertet has announced that its 2009 turnover increased by 0.6% to 305.1 million euro. The company's flavor division (accounting for about 40% of the company's total turnover), reported a 5.3% growth to 122.3 million euro.

Takasago 3 Qtrs 2009-2010 Sales Results - Feb. 12, 2010 - For the 3 Qtrs period, April 1, 2009 - December 31, 2009, sales declined 9.5% to ¥ 87,576,000. The company projects a Consolidated Financial Sales Forecast for the fiscal year (April 1, 2009 - March 31, 2010) of ¥ 117,000,000, a decline year over year of 5.6%.

Mane 2009 Sales increase 13% - February 08, 2010 - Mane achieved a turnover of 376.2 million euros in 2009, up 13.1% from 332.5 million euros in 2008 (personal communication).

Sensient F&F 4th Qtr & Full Year 2009 Sales - February 05, 2010 - The Flavors & Fragrances Group of Sensient reported revenue for the 4th Qtr. of $195.96 million, an increase of 2.3% compared to to the same period in 2008. For the full year, sales declined 3.5% to $772.87 million vs the same 2008 period. As these figures include dehydrated products such as dehydrated vegetables that are about 29% of sales, we estimate that the sales of conventional flavors & fragrances in 2009 were about $548.7 million.

T. Hasegawa 2008-2009 Sales Results - November 13, 2009 - for the full year ending September 30, 2009 consolidated net sales were ¥ 43,244,000, down 4.8%. For the same period, earnings declined 19.9% to ¥ 1,792,000. For the fiscal year ending September 30, 2010 the company projects that consolidated net sales will increase 2.3% to ¥ 44,260,000. In our table, these are listed as "2009" sales.

----------------------------------------------------------------------------------------------------

Firmenich 2008-2009 Sales - Oct. 7, 2009 - For the financial year ended June 30, 2009, Firmenich posted sales of CHF 2,641 million, a decline of 4.3% in local currencies. Consumer products linked to basic needs, like eating, drinking, washing and cleaning, were the most resistant to economic crisis, while discretionary Fine Fragrance suffered most. (It should be noted , in contrast to most other companies who reported full year sales as of December 31, Firmenich reported sales were from July 1, 2008 to June 30, 2009 - the period of the world's worst economic and financial crisis). In our table, these are listed as "2008" sales.

Takasago 2008-2009 Sales - May 14, 2009 - Sales for the full fiscal year ending March 31 were ¥123,973 million, down 0.2% from the prior year - but beating the latest projection of ¥122,000 million issued in February. Flavor sales for the year increased 2.5% while fragrance sales declined 3.4%. Aroma chemical & Fine chemicals (combined) declined 4%.

Frutarom Full Year 2008 Sales - Haifa, Israel – March 19, 2008 - Frutarom reported record sales of US$ 473.3 M for the year 2008 - a growth of 25% compared with 2007, excluding the effect of the strengthening of European currencies and the Shekel against the US dollar. Without excluding the aforementioned effect, sales increased by 28.5%. At the same time, Frutarom achieved an increase of 34.8% in the annual gross profit to US$ 176.3 M, an improvement of gross margin to 37.2% compared to 35.5% last year, a leap of 64% in operating profit which totaled US$ 56.6 M. During the 4th Qtr of 2008, Frutarom's sales totaled US$ 98.7 M, a decrease of 1% compared to the same quarter last year, excluding the effect of the weakening of the European currencies and the Shekel (in which most of Frutarom's sales are made) against the US dollar, at rates of up to 24%. Without excluding the aforementioned effect, sales decreased by 9%. The considerable trend of reducing inventory levels among Frutarom's customers worldwide in the last few months, also affected the decrease in sales during the fourth quarter.

Symrise Full Year 2008 Sales Results - Holzminden, March 4, 2009 - Overall sales for 2008 increased to EUR 1,319.9 million (+6.5% in local currencies and +3.6% in euros). Scent & Care increased to EUR 671.8 million (+3% in local currencies and +0.1% in euros). Flavor & Nutrition increased to EUR 648.1 million (+10.5% in local currencies and +7.4% in euros). For the year, net income dipped -7% in euros and - 2% in local currencies to € 90.4 million. "The sales performance of Scent & Care in fiscal 2008 was mixed. While Life Essentials, Household, Aroma Molecules and Mint performed according to plan, the “luxury segments” Fine Fragrances and Personal Care had to contend with demand problems caused by the global economic situation. In 2008, Scent & Care generated sales of € 671.8 million. As a result, including the acquisitions Intercontinental Fragrances and Manheimer Fragrances, sales reached the previous year’s mark. At local exchange rates Scent & Care’s sales were up by 3%. Excluding Intercontinental Fragrances and Manheimer Fragrances, sales fell slightly by 0.7% to € 666.8 million (+ 2.2% on a local currency basis). Including Chr. Hansen Flavors, Flavor & Nutrition recorded sales of € 648.1 million in 2008, an increase of 7.4% (10.4% at local rates). Excluding Chr. Hansen Flavors, sales rose by 2.4% to € 617.5 million (5.0% on a local currency basis). After the acquisition in April, Chr. Hansen flavors posted sales of € 30.6 million."

Givaudan Full Year 2008 Sales Results - Geneva, 17 February 2009. In 2008, Givaudan group sales totalled CHF 4,087 million, an increase of 6.7% in local currencies and a decrease of 1.1% in Swiss francs compared to 2007. On a pro forma basis, excluding the impact of the ongoing portfolio streamlining, sales increased by 2.5% in local currencies. Including this effect, sales on pro forma basis increased by 1.0% in local currencies and decreased by 6.4% in Swiss francs. Fragrance Division sales were CHF 1,898 million, an increase of 7.9% in local currencies and a decrease of 0.1% in Swiss francs versus 2007. On a pro forma basis, and, excluding the impact of discontinued ingredients, sales grew by 1.7% in local currencies. Sales of the Flavour Division were CHF 2,189 million, an increase of 5.8% in local currencies and a decrease of 2.0% in Swiss francs compared to the previous year. On a pro forma basis, and, excluding the streamlining of commodity ingredients and the St. Louis divestment, sales increased by 3.1% in local currencies.

IFF Full Year 2008 Sales Results - Feb. 5, 2009 - Full year 2008 reported sales totaled $2,389 million, up 5% from 2007; Flavor and Fragrance sales increased 9% and 2%, respectively. 2008 sales benefited from the weaker U.S. dollar for most of the year. At comparable exchange rates, sales would have increased 2% over the prior year. Net Income was $230 million versus $247 million in 2007. The change is mainly attributable to $32 million of higher interest expense in 2008, partially offset by higher volume and favorable currency impacts. 4th Qtr. Sales in local currency increased 2% versus the comparable period in 2007, whereas reported sales of $539 million were down 3% due to the strengthening U.S. dollar. 4th Qtr. flavor sales were up 3% in local currencies while reported sales worldwide declined 1%, reflecting the stronger U.S. dollar. Fragrance sales in local currency were flat versus the comparable period last year, while reported sales were down 4%.

Sensient F&F Full year 2008 Sales Results - Feb. 5, 2008 -Sensient Flavors & Fragrances reported record revenue and operating income in 2008. Annual revenue for the Group increased 5.4% to $809.6 million, compared to $768.1 million in 2007. As these figures include dehydrated products such as dehydrated vegetables that are about 27% of sales, we estimate that the sales of conventional flavors & fragrances in 2008 were about $591 million. Operating income in 2008 was up 7.6% to $123.5 million, compared to $114.7 million in 2007. For the 4th Qtr. F&F revenue was $193.5 million, off 1.2% compared to 4th quarter 2007 revenue of $195.8 million. Quarterly operating profit of $29.2 million was down 1.8% compared to prior year fourth quarter operating income of $29.7 million. Quarterly revenue and operating income on a local currency basis increased 5.8% and 5.4%, respectively. The stronger US dollar currency translation reduced reported revenue and operating income for the Flavors & Fragrances Group by approximately 7% in the 4th quarter.

Robertet Sales for 2008 - Jan 20, 2009 - For the full year 2008, sales increased 25.7% to 303.17 Million Euros, reflecting the full year integration of the Charabot sales.

Mane 2008 Sales - Sales for the full year 2008 rose to 332.5 million Euros, an increase of 8.2% year over year (personal communication).

Takasago Year 2008/9 Sales Projections - Feb. 12, 2009 - Takasago has reduced its sales projections for the full fiscal year 2008/2009 ending Mach 31 to ¥122,000 million.

T. Hasegawa 2008 Sales Results - for the full year ending September 30, 2008 consolidated net sales were ¥ 45,421,000, down 9.3%. For the same period, net profit declined 46% to ¥ 2,238,000.

Takasago Year 2008/9 Sales Projections - Feb. 12, 2009 - Takasago has reduced its sales projections for the full fiscal year 2008/2009 ending March 31 to ¥122,000 million.

Firmenich 2007-2008 Sales - Oct. 9, 2008 - Firmenich posted strong sales growth for its fiscal year ended June 30, 2008, despite an economic downturn during the second half of the year. Sales increased 18.4% in local currencies, 13.5% in Swiss Francs, to reach an annual turnover of CHF 2,847 million. In our table, these are listed as "2007" sales.

Rank is based on US$

equivalents

(1) Estimated 1999 Total World

Flavor & Fragrance Sales of US $12.9 Billion. Again in year

2000, we estimate that sales growth in local currencies was about

3-4%, but the continued strengthening of the U.S. dollar against

major currencies once again leaves the estimated total market in U.S.

dollars at about U.S 12.9 Billion. For 2001 we believe that growth in

local currencies was about 2% or less and that in US $ equivalents

the market shrank to about U.S $12.7 Billion based on the strength of

the dollar. For 2002, we estimate that the total world market is

$15.1 billion. This sizable increase reflects a decrease in the value

of the U.S. dollar of about 17.8% vs. major currencies at 12/31/02 vs

12/31/01. The continued weakness of the U.S. dollar in 2003 against

the worlds major currencies (a decline of about 16%) again has

affected the size of the total market in U.S. dollars (the 2003

estimate being about U.S. $16.3 billion). For 2004, the U.S. $ was

again down about 5-6% against major currencies. We estimate that

growth in local currencies was about 3% resulting in a total market

size of about U.S. $17.7 billion. For 2005, the U.S. $ strengthened

by about 12% against major currencies. We estimate that growth in

local currencies was about 3% in 2005 resulting in a total market

size of about U.S. $16.0 billion. For 2006, the US $ declined in

value against the world's major currencies by about 9%. We estimate

that growth in local currencies was about 3-4% resulting in a total

market size of about U.S. $18 billion. For 2007,

the US $ again declined in value against the world's major currencies

by about 5.8%. For 2007, we estimate that growth in local currencies

was about 4.5% resulting in a total market size of about

U.S. $19.8 billion.

In 2008, based on comparison of major currency rates (on Dec.31), the U$ $ had a decline of 6% against the Swiss Franc, a 23% decline against the Japanese Yen and about a 5% gain aganst the Euro. However, comparing single points in time can be somewhat misleading as during the period of March to August 2008, the dollar had a decline of about 26% against the Euro in the same prior year period. In addition, the deteriorating worldwide economic situation during the last 1/3 of the year negatively impacted sales volumes. At best we estimate that the total market grew in 2008 at about 2.5-3.0% in US $.

It should be noted that Givaudan in 2001 estimated the total F&F market at "roughly" 15 billion CHF (U.S. $ 8.7 billion) while in a market study (April , 2001) ChemSynergy estimates the market for flavor and fragrance products is at present globally in the order of $12.24 billion. Also in a market study by The Freedonia Group, they estimated the world F&F market as $14.15 billion in 1999 with a projected growth to $18.4 billion by 2004. Get a copy of the Freedonia Press Release.

For a historical review of Total Market Size, see below.

Lazlo Unger, an economist at Givaudan , estimated the world F&F market at US 4.0 billion in 1979, 4.2 billion in 1981 (Source: Perfumer & Flavorist, Vol. 7, August/September, 1982, p. 52) and 7.0 billion in 1987 (Source: Perfumer & Flavorist, Vol .14, May/June, 1989, p. 43). Hans Hartmann of H&R estimated the world F&F market at US $ 7.8 billion in 1990 and 9.6 billion in 1995 (Source: Perfumer & Flavorist, Vol .21, March/April, 1996, p. 22), and the flavor market (only) at 4.5 billion in 1994 (Source: Perfumer & Flavorist, Vol . 20, September/October, 1995, p. 35). Ron Fenn of IFF estimated the total F&F market in 1995 at about US $ 10 billion and projected a market of 12 billion in the year 2000 (Source: Perfumer & Flavorist, Vol .23, March/April, 1996, p. 11 ) in concurrence with (or based on) Hartmann's estimates.

For information, Chemical & Engineering News (for 2002) and Unger (for 1987) estimated world F&F sales by category as follows:

|

|

|

|

|

Fragrance compounds |

|

|

|

Flavor compounds |

|

|

|

Aroma Chemicals |

|

|

|

Essential Oils & Other Natural Products |

|

|

Takasago 2006-2007 Record Sales - May 15, 2007 - Sales for the fiscal year ending March 31st were ¥113,876 million, up 7.7% from the prior year. Net income increased 68% to ¥ 4,885 million.

Givaudan 2006 Sales - February 20, 2007 - Geneva, Switzerland, 20 February 2007. In 2006, Givaudan’s total sales increased to CHF 2,909 million, representing a 4.7% rise in Swiss Francs and a 3.5% rise in local currencies. Despite the continued ingredients streamlining in both divisions, the company continued to deliver above market sales growth for the sixth consecutive year. This streamlining impacted annual sales by CHF 33 million. Without this effect, sales in local currencies would have increased by 4.9%

Takasago 3d Qtr 2006 Results - Feb. 13, 2007 - Gross Sales for the period April 1- December 31, 2006 increased 6.7% to ¥84,136,000. Operating profit for the same period increased 10% to ¥5,274,000.

Robertet 2006 Sales - reported 2006 sales were 221,127 million euros, an increase of 6.8% over 2005 sales.

Symrise 2006 Sales - Feb. 6, 2007 - Symrise has reported preliminary sales results for 2006 of 1,230.0 million euros, up 7% from 2005. Preliminary EBITDA for 2006 was reported as 243.0 million euros, up 25.8%.

Quest 4th Qtr & full year 2006 Sales - Feb. 8, 2007 - Quest's 4th Qtr. sales increased 2.9% to 143 £m while full year 2006 sales were up 5% to 588 £m. 4th Qtr trading profit increased 36% to 15 £m while full year 2006 trading profit was up 7% to 76 £m.

Sensient F&F 4th Qtr & full year 2006 Sales - Feb. 12, 2007 - Sensient's Flavors & Fragrances Group achieved record results in 2006, as revenue for the twelve months increased 9.4% to $733.4 million and operating income increased 26.7% to $104.5 million. Flavors & Fragrances Group revenue grew 9.4% to $185.0 million in the quarter ended December 31, 2006, compared to $169.1 million in the prior year's fourth quarter. Quarterly operating income jumped 42.8% to $27.0 million compared to $18.9 million in the fourth quarter of 2005. As approximately 23% of F&F sales historically has been in dehydrated vegetables, we estimate that Sensient's true F&F sales were about $565 million for year 2006.

IFF 4th Qtr & Full Year 2006 Results - New York, N.Y., January 30, 2007 … Fourth quarter 2006 sales totaled $514 million, up 11% from the prior year quarter; fragrance and flavor sales increased 13% and 7%, respectively. Sales for the 4th quarter benefited from the generally weaker U.S. dollar; at comparable exchange rates, sales would have increased 7% in comparison to the 2005 quarter. Net income for the 2006 fourth quarter, including $1 million in after tax restructuring charges, totaled $44 million, a 192% increase compared with the prior year quarter. The 2005 fourth quarter result of $15 million included restructuring charges of $16 million after tax. Excluding the restructuring charges from both years, net income increased 48% in the 2006 fourth quarter. Sales for the full year 2006 increased 5 percent to $2.10 billion from $1.99 billion in the prior year. For year 2006, fragrance sales increased 5% and flavors increased 4%. Net income for 2006, including $2 million in after tax restructuring charges, totaled $223 million, a 15% increase compared with the prior year. Full year 2005 results of $193 million included restructuring charges totaling $16 million after tax, as well as a tax benefit of $25 million relating to repatriation of funds from overseas affiliates. Excluding the restructuring charges from both years and the one-time tax benefit from 2005, net income in 2006 increased 22% versus the comparable 2005 result.

T. Hasegawa 2006 Sales Results - for the full year ending September 30, 2006 consolidated net sales were ¥47,000,000, down 1.6% while consolidated net income declined 4.35% to ¥ 3,713,000.

Disclaimer: The figures reported are

derived from reliable published sources and represent our

best estimates. We disclaim any material interest in any of

the companies for which information is provided. Statements

presented here which are not historical facts or information

must be considered "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of

1995, and are subject to risks and uncertainties that could

cause a company's actual results to differ materially from

those expressed or implied by such forward-looking

statements. Risks and uncertainties with respect to a

company's business include general economic and business

conditions, the price and availability of raw materials, and

political and economic uncertainties, including the

fluctuation or devaluation of currencies in countries in

which a company does business. Investors should not accept

any information presented here as fact without independent

verification. If errors are found in our market analysis, we

would gratefully accept factual corrections. This information is provided gratis as a

service to those in the Flavor & Fragrance

industry.

Comments on Total Market Size (2006-2008)

Leffingwell & Associates includes "ingredient" sales in their sales estimations, some of which run through the sales of the major F&F companies (e.g. especially Givaudan, Firmenich, Symrise, Takasago & IFF). It should be obvious that other F&F suppliers such as Mastertaste, AM Todd, Huabao International, Ogawa, Kao, BASF., Rhodia. Citrus & Allied. Millennium Specialty Chemicals div. of Lyondell, Bell Flavors & Fragrances, Cargill Flavor Systems, Camphor & Allied Products, Etol d.d, Shiono Koryo Kaisha, Nagaoka Perfumery (all with estimated sales in the range of about $50-250 million), plus the other ~400 F&F companies, are important to the total market size. One of the controversial problems in estimating total market size has to do with potential (or real) double counting of sales. This is a particular issue in the case of "ingredients". For example - in the case of essential oils and aroma chemicals they are often sold twice, e.g., the producer sells to a company which then sells to another company. For essential oils, these often require a distillation and standardization before the are ready for the end user F&F company. Or in the case of aroma chemical producers, they may sell to another company (in bulk) who then repackages in smaller containers for further sale. These multiple transactions are considered by Leffingwell as being "value added" for the ultimate F&F customer and are therefore included in our figures for total market size.

It should be noted in 2005 Freedonia projected that the F&F market size would be about $18.6 billion by 2008 (http://www.freedoniagroup.com/brochure/18xx/1886smwe.pdf) and that Business Insights estimated the F&F market to be $18 billion in 2006 (http://www.globalbusinessinsights.com/content/rbig0001m.pdf). Similarly, in 2005 Frost and Sullivan estimated that the top five suppliers accounted for approximately 54 percent of the total F&F revenues (which translates to a slightly higher estimate for the total market size than the Leffingwell estimate). See http://www.frost.com/prod/servlet/report-overview.pag?repid=B722-01-00-00-00&ctxst=FcmCtx1&ctxht=FcmCtx2&ctxhl=FcmCtx3&ctxixpLink=FcmCtx4&ctxixpLabel=FcmCtx5

However, we are aware that IAL Consultants (see below) estimates the 2006 market size at about $12.6 billion and that Firmenich estimated that for 2006-2007 that the total market size was closer to US$15 billion. Similarly, Givaudan has estimated the total market size at about CHF 17-18 billion (about US $16.9-17.9 billion) ( see http://www.givaudan.com/staticweb/StaticFiles/GivaudanExtranet/Publications/fin_pubs/fy_report/2008/givaudan_2008_fy_an_fn.pdf ). Some of these discrepancies may arise from the "double counting" of sales issue discussed above.

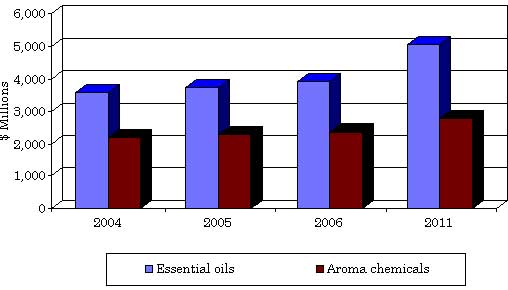

A recent report on the size of the Essential oil and Aroma chemical market size is of interest.

BCC Research reports

on the 2006 market for Essential oils and Aroma

chemicals at http://www.bccresearch.com/report/CHM034B.html

BCC Research reports

"The worldwide flavors and fragrance

"ingredient" market is

estimated to be worth approximately $6.3 billion in

2006. Poised for an average annual growth rate

(AAGR) of 4.5% per year, this value should grow to $7.8 billion in

2011. Flavors and fragrances have similar economic and operational

characteristics, including research and development, the nature of

the creative and production processes, the manner in which the

products are distributed and the preferences of the customers. World

demand for quality essential oils and their derivatives is likely to

see increasing demand in the coming years, and natural products will

continue to remain an important part of the flavors and fragrances

industry. The market should reach $5.0 billion by 2011, an AAGR of

5.2%."

............................................................. Estimated 2006 Worldwide Essential Oil & Aroma Chemical Sales

...............................................................

...............................................................Source;

BCC Research Report ID:CHM034B, Published: December 2006,

Analyst: N. S. Venkataraman

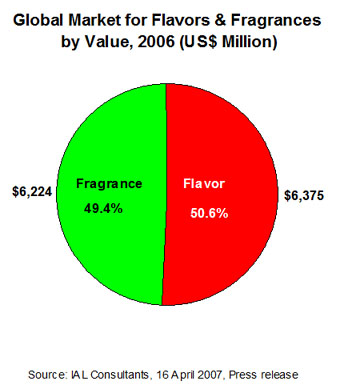

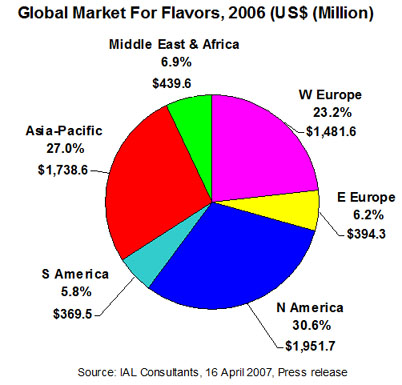

April 16, 2007 - A Press Release from IAL

Consultants estimated the World F&F market at $12.6 billion. As

their figures for the total market are close to that firmly

documented for the top ten companies, they must be excluding

much of the sales of the nearly 400+ other companies in the

F&F Industry. The following charts shows their estimates as

to the market breakdown. See http://www.ialconsultants.com/website/pdf/8289P.pdf

...... ..........

..........

June 23, 2000 - A press release from

IAL Consultants estimated the World F&F market at $10.4

billion. The following charts shows the estimates as to the market

breakdown.

Copyright © 2000-2009 by

Leffingwell &

Associates

General Notice: Leffingwell &

Associates strives to ensure that the information contained in this

Web site is accurate and reliable. However, Leffingwell &

Associates and the Web Master are not infallible, and errors may

sometimes occur. Therefore, Leffingwell & Associates disclaims

any warranty of any kind, whether express or implied, as to any

matter whatsoever relating to this Web site, including without

limitation the merchantability or fitness for any particular purpose.

Leffingwell & Associates will from time to time revise the

information, services and the resources contained in this Web site

and reserves the right to make such changes without any obligation to

notify past, current or prospective visitors. In no event shall

Leffingwell & Associates be liable for any direct, indirect,

special, incidental, or consequential damages arising out of any use

of the information contained herein.